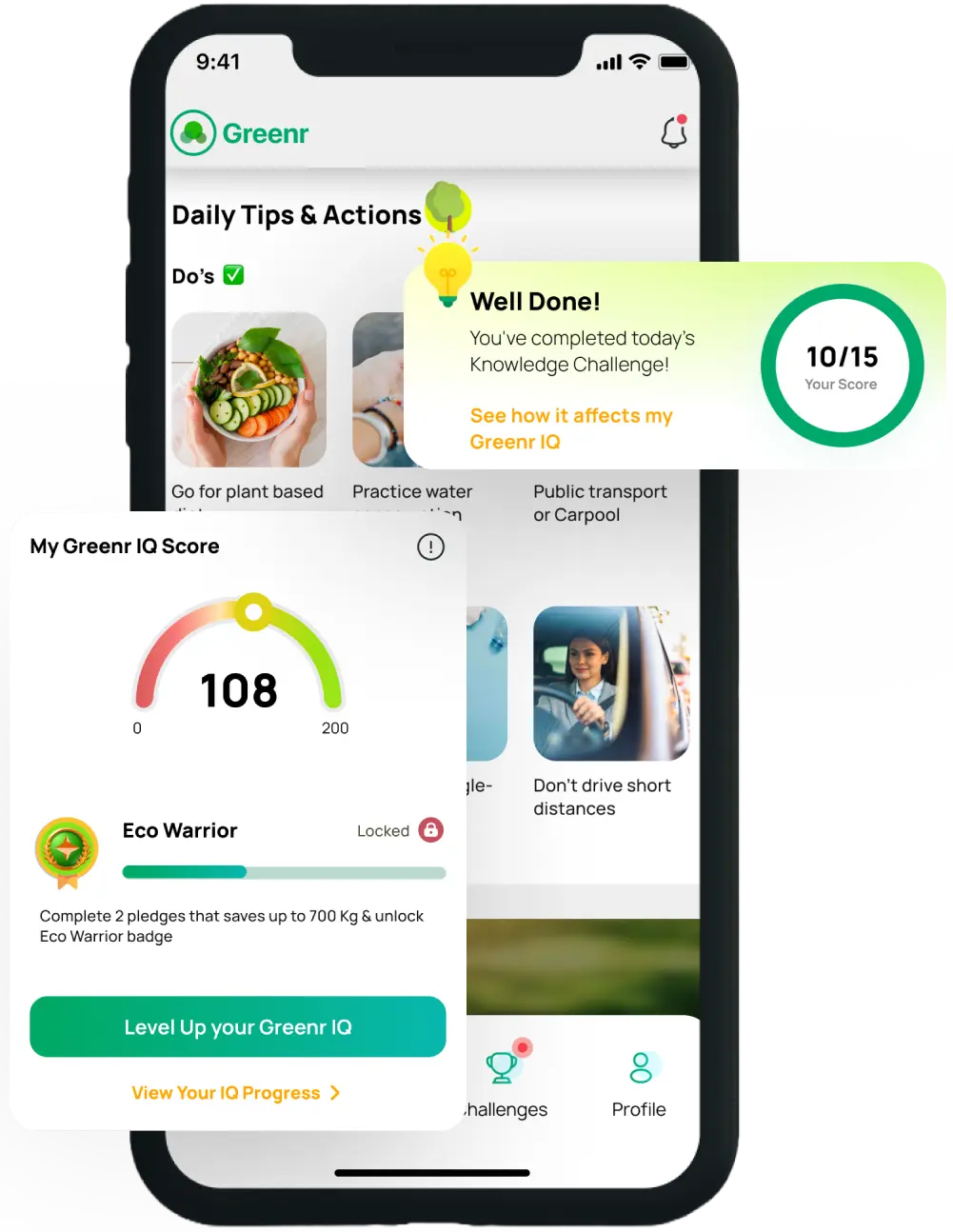

Level up your sustainability IQ for a Greenr future

Empower your workforce to make sustainability a reality. Inspire your employees to take meaningful steps towards achieving your company’s environmental goals.

Greenr at Work

Harness collective power to tackle environmental challenges

Greenr is a Sustainability as a Service Platform that offers an employee engagement app to educate and empower the world’s largest workforce - “Employees”. We aim to engage employees to share responsibility &contribute towards companies’ net zero targets.

Our Approach

Greenr's Impact

Measuring Our Eco Achievements

10298

T of CO2e avoided for the planet

452000

Equivalent trees growing for 1 year

4520

Cars off the road

72

Countries reached

Our Partners

Success Stories

See how Greenr has helped organizations drive global sustainability. Discover testimonials showcasing positive environmental impacts.

Success Stories

See how Greenr has helped organizations drive global sustainability. Discover testimonials showcasing positive environmental impacts.

Frequently Asked Questions

Greenr assists organizations by integrating sustainable practices into their operations, offering cutting-edge technology solutions, and fostering a culture of sustainability. Our holistic approach ensures lasting impact and measurable results.

Greenr offers sustainable solutions such as education on corporate policies, gamification for employee engagement, collaboration platforms for project execution, tools for goal tracking and measurement, and recognition programs for celebrating achievements—all aimed at fostering a culture of sustainability within organizations.

Greenr helps organizations achieve sustainability by educating employees on corporate policies and best practices, motivating them through gamification and rewards, facilitating collaboration on sustainability projects, providing tools for tracking and measuring goals, and fostering a culture of recognition for sustainable achievements. This holistic approach empowers organizations to implement and sustain impactful environmental initiatives across their operations.

Greenr helps organizations meet industry sustainability standards by providing tools for setting and tracking goals, fostering collaboration among teams, and offering expert guidance on implementing sustainable practices. This enables businesses to align with industry best practices and achieve measurable environmental impact.

Let’s Get in Touch

Fill out the form to discover what Greenr can do for you! Our team will reach out to schedule your demo.

OR

Reach out to us -support@greenr.com